Worksheet Management

Introduction:

Worksheets in a workbook may contain data on more than one sheet and it is important to understand how to move and copy a worksheet to the same workbook or another workbook.

Learning:

Moving and Copying Worksheets in the Same Workbook

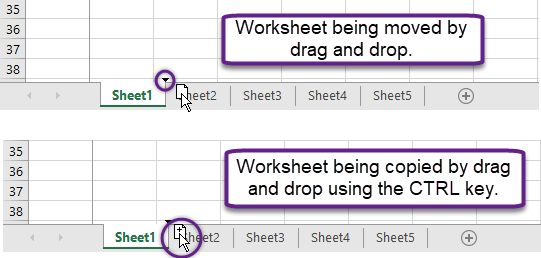

To move sheets within the same workbook Excel allows you to drag and drop worksheets. You can drag a worksheet to a new position which will be indicated in Excel by a small black downward arrow that indicates where the worksheet will be positioned when you release the mouse button.

Copying worksheets is also easy, as you can use the same drag and drop method to copy a sheet by holding down the Control (CTRL) key. By holding the CTRL key while dragging and dropping a worksheet you will create a new copy of that worksheet.

Moving and Copying Worksheets to a New Workbook

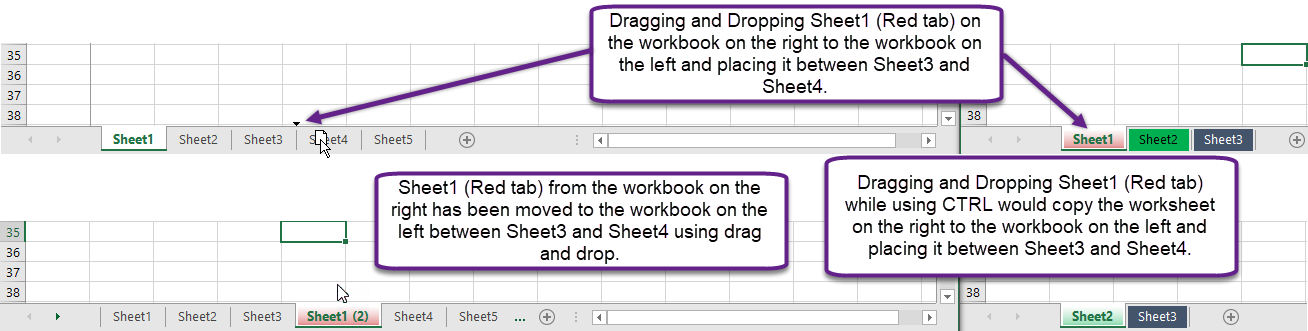

Instead of traditional copying and pasting of information from one worksheet to another in an existing workbook, Excel makes it easy to move and copy worksheets to existing workbooks. You can use the drag and drop method to either completely move a worksheet to another existing workbook or make a copy of a worksheet and copy to another workbook.

To move a worksheet to a new workbook, select the just drag and drop the worksheet from one workbook to another. If you want to make a copy of the worksheet in another workbook, hold the Control (CTRL) key down while you drag and drop. It is that easy.

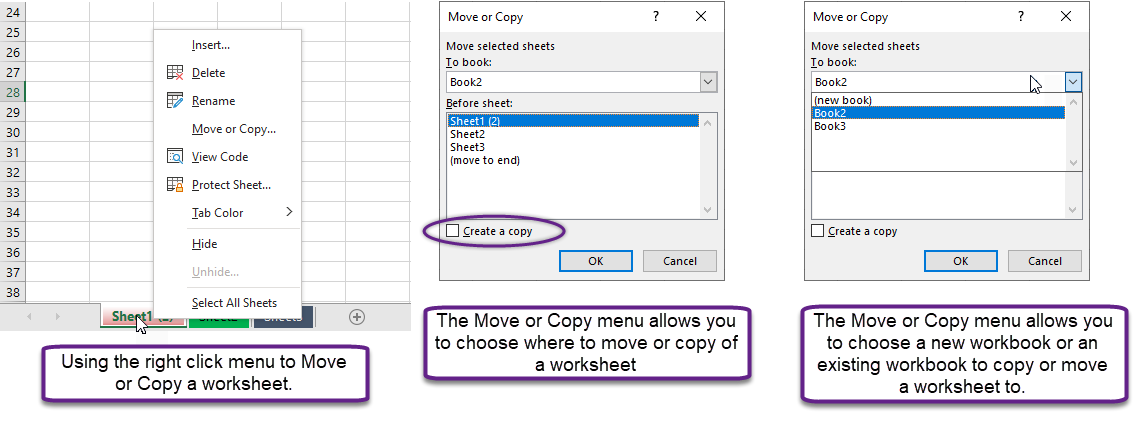

You can also use the Move or Copy menu by right clicking a worksheet tab.

Moving and copying worksheets to a new workbook can easily be done through the Move or Copy menu by right clicking a worksheet tab. When using the Move or Copy tool, select a new workbook from the dropdown menu at the top of the dialog box to create and move or copy your worksheet. Be sure to use the “Create a copy” checkbox if you want to copy the worksheet.

Summary:

Worksheets in a workbook can be moved or copied to existing and new workbooks using built in menu’s and dragging and dropping using worksheet tabs. Either method provides the user with an easy way to manipulate workbooks that contain multiple worksheets or to transfer information from one workbook to another.

Sources:

IDM