In 1791, the Bank of the United States was established. Alexander Hamilton, the first Secretary of the Treasury, lobbied for the creation of the Bank of the United States. The Bank effectively controlled U.S. monetary policy. Many prominent individuals opposed the creation of the Bank of the United States. Most significantly, Thomas Jefferson argued that the bank was a symbol of creeping tyranny in America. Andrew Jackson was the staunchest opponent of the Bank of the United States. He vetoed a motion to grant a renewed charter to the Bank of the United States. Like Jefferson, Jackson viewed the Bank of the United States as an instrument of power through which the wealthy elite dominated the masses. Jackson ordered that no federal deposits be made to the Bank of the United States. This sparked a massive financial crisis and economic depression.

History of American Banking

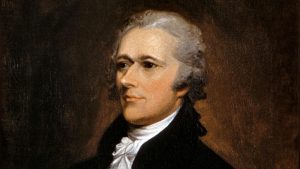

President George Washington chose Alexander Hamilton to be his Secretary of the Treasury. Hamilton wanted an active government that would promote prosperity by supporting American industry.

Hamilton wanted Congress to create a bank—a Bank of the United States. Hamilton’s plan for a Bank of the United States won congressional approval despite strong opposition. Thomas Jefferson and other Republicans argued that the plan was unconstitutional. Hamilton, however, argued that the bank was not only constitutional but also important for the country’s prosperity. The Bank of the United States would fulfill several needs. It would act as a convenient depository for federal funds. It would print paper banknotes backed by specie (gold or silver). Its agents would also help control inflation by periodically taking state bank notes to their banks of origin and demanding specie in exchange, limiting the amount of notes the state banks printed. Furthermore, it would give wealthy people a vested interest in the federal government’s finances. The government would control just twenty percent of the bank’s stock; the other eighty percent would be owned by private investors. Thus, an “intimate connexion” between the government and wealthy men would benefit both, and this connection would promote American commerce.

In 1791, therefore, Congress approved a twenty-year charter for the Bank of the United States. The bank’s stocks, together with federal bonds, created over $70 million in new financial instruments. These spurred the formation of securities markets, which allowed the federal government to borrow more money and underwrote the rapid spread of state-charted banks and other private business corporations in the 1790s. For Federalists, this was one of the major purposes of the federal government. For opponents who wanted a more limited role for industry, however, or who lived on the frontier and lacked access to capital, Hamilton’s system seemed to reinforce class boundaries and give the rich inordinate power over the federal government.

Andrew Jackson and the Bank Crisis

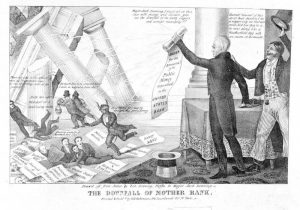

The most characteristic struggle of Andrew Jackson’s presidency was financial. As president, he waged a “war” against the Bank of the United States.

The charter of the controversial national bank that Congress established under Alexander Hamilton’s financial plan expired in 1811. But five years later, Congress had given a new charter to the Second Bank of the United States. Headquartered in Philadelphia, the bank was designed to stabilize the growing American economy. By requiring other banks to pay their debts promptly in gold, it was supposed to prevent them from issuing too many paper banknotes that could drop suddenly in value. Of course, the Bank of the United States was also supposed to reap a healthy profit for its private stockholders.

Though many Democratic-Republicans had supported the new bank, some never gave up their Jeffersonian suspicion that such a powerful institution was dangerous to the republic. Andrew Jackson was one of the skeptics. He and many of his supporters blamed the bank for the Panic of 1819, which had become a severe economic depression. The national bank had made that crisis worse, first by lending irresponsibly and then, when the panic hit, by hoarding gold currency to save itself at the expense of smaller banks and their customers. Jackson’s supporters also believed the bank had corrupted many politicians by giving them financial favors.

In 1829, after a few months in office, Jackson set his sights on the bank and its director, Nicholas Biddle. Jackson became more and more insistent over the next three years as Biddle and the bank’s supporters fought to save it. For Jackson, the struggle was a personal crisis. “The Bank is trying to kill me,” he told Martin Van Buren, “but I will kill it!”

The bank’s charter was not due for renewal for several years, but in 1832, while Jackson was running for re-election, Congress held an early vote to reauthorize the Bank of the United States. The president vetoed the bill.

In his veto message, Jackson called the bank unconstitutional and “dangerous to the liberties of the people.” The charter, he explained, didn’t do enough to protect the bank from its British stockholders, who might not have Americans’ interests at heart. In addition, Jackson wrote, the Bank of the United States was virtually a federal agency, but it had powers that were not granted anywhere in the Constitution. Worst of all, the bank was a way for well-connected people to get richer at everyone else’s expense. Only a strictly limited government, Jackson believed, would treat people equally.

Although its charter would not be renewed, the Bank of the United States could still operate for several more years. So in 1833, to diminish its power, Jackson also directed his cabinet to stop depositing federal funds in it. From now on, the government would do business with selected state banks instead.

Jackson’s bank veto set off fierce controversy. Opponents in Philadelphia held a meeting and declared that the president’s ideas were dangerous to private property. Jackson, they said, intended to “place the honest earnings of the industrious citizen at the disposal of the idle”—in other words, redistribute wealth to lazy people—and become a “dictator.” A newspaper editor said that Jackson was trying to set “the poor against the rich,” perhaps in order to take over as a military tyrant. But Jackson’s supporters praised him. Pro-Jackson newspaper editors wrote that he had kept a “monied aristocracy” from conquering the people.

By giving President Jackson a vivid way to defy the rich and powerful, the Bank War gave his supporters a specific “democratic” idea to rally around. More than any other issue, opposition to the national bank came to define their beliefs. And by leading Jackson to exert executive power so dramatically against Congress, the Bank War also helped his political enemies organize.

Increasingly, supporters of Andrew Jackson referred to themselves as Democrats. Under the strategic leadership of Martin Van Buren, they built a highly organized national political party, the first modern party in the United States. Much more than earlier political parties, this Democratic Party had a centralized leadership structure and a consistent ideological program for all levels of government. Meanwhile, Jackson’s enemies, mocking him as “King Andrew the First,” named themselves after the patriots of the American Revolution, the Whigs.

The Panic of 1837

Unfortunately for Jackson’s Democrats, their victory over the Bank of the United States worsened rather than solved the country’s economic problems.

Things looked good initially. Between 1834 and 1836, a combination of high cotton prices, freely available foreign and domestic credit, and an infusion of specie (“hard” currency in the form of gold and silver) from Europe spurred a sustained boom in the American economy. At the same time, sales of western land by the federal government promoted speculation and poorly regulated lending practices, creating a vast real estate bubble.

Meanwhile, the number of state-chartered banks grew from 329 in 1830 to 713 just six years later. As a result, the volume of paper banknotes per capita in circulation in the United States increased by forty percent between 1834 and 1836. Low interest rates in Great Britain also encouraged British capitalists to make risky investments in America. British lending across the Atlantic surged, raising American foreign indebtedness from $110 to $220 million over the same two years.

As the boom accelerated, banks became more careless about the amount of hard currency they kept on hand to redeem their banknotes. And although Jackson had hoped his bank veto would reduce bankers’ and speculators’ power over the economy, it actually made the problems worse.

Two further federal actions late in the Jackson administration also worsened the situation. In June 1836, Congress decided to increase the number of banks receiving federal deposits. This plan undermined the banks that were already receiving federal money, since they saw their funds distributed to other banks. Next, seeking to reduce speculation on credit, the Treasury Department issued an order called the Specie Circular in July 1836, requiring payment in hard currency for all federal land purchases. As a result, land buyers drained eastern banks of even more gold and silver.

By late fall in 1836, America’s economic bubbles began to burst. Federal land sales plummeted. The New York Herald reported that “lands in Illinois and Indiana that were cracked up to $10 an acre last year, are now to be got at $3, and even less.” The newspaper warned darkly, “The reaction has begun, and nothing can stop it.”

Runs on banks began in New York on May 4, 1837, as panicked customers scrambled to exchange their banknotes for hard currency. By May 10, the New York banks, running out of gold and silver, stopped redeeming their notes. As news spread, banks around the nation did the same. By May 15, the largest crowd in Pennsylvania history had amassed outside of Independence Hall in Philadelphia, denouncing banking as a “system of fraud and oppression.”

The Panic of 1837 led to a general economic depression. Between 1839 and 1843, the total capital held by American banks dropped by forty percent as prices fell and economic activity around the nation slowed to a crawl.

Source: The American Yawp. A Free and Online, Collaboratively Built American History Textbook, 2017-2018 Edition.

History of American Banking

The architects of the Constitution committed themselves to leading the new republic, and they held a majority among the members of the new national government. Indeed, as expected, many assumed the new executive posts the first Congress created. Washington appointed Alexander Hamilton, a leading Federalist, as secretary of the treasury.

Alexander Hamilton’s Program

Alexander Hamilton, Washington’s secretary of the treasury, was an ardent nationalist who believed a strong federal government could solve many of the new country’s financial ills. Born in the West Indies, Hamilton had worked on a St. Croix plantation as a teenager and was in charge of the accounts at a young age. He knew the Atlantic trade very well and used that knowledge in setting policy for the United States. In the early 1790s, he created the foundation for the U.S. financial system. He understood that a robust federal government would provide a solid financial foundation for the country.

As secretary of the treasury, Hamilton hoped to stabilize the American economy by establishing a national bank. The United States operated with a flurry of different notes from multiple state banks and no coherent regulation. By proposing that the new national bank buy up large volumes of state bank notes and demanding their conversion into gold, Hamilton especially wanted to discipline those state banks that issued paper money irresponsibly. To that end, he delivered his “Report on a National Bank” in December 1790, proposing a Bank of the United States, an institution modeled on the Bank of England. The bank would issue loans to American merchants and bills of credit (federal bank notes that would circulate as money) while serving as a repository of government revenue from the sale of land. Stockholders would own the bank, along with the federal government.

Hamilton’s bank proposal generated opposition. Jefferson, in particular, argued that the Constitution did not permit the creation of a national bank. In response, Hamilton again invoked the Constitution’s implied powers. President Washington backed Hamilton’s position and signed legislation creating the bank in 1791.

With the support of Washington, the entire Hamiltonian economic program received the necessary support in Congress to be implemented. In the long run, Hamilton’s financial program helped to rescue the United States from its state of near-bankruptcy in the late 1780s. His initiatives marked the beginning of an American capitalism, making the republic creditworthy, promoting commerce, and setting for the nation a solid financial foundation. His policies also facilitated the growth of the stock market, as U.S. citizens bought and sold the federal government’s interest-bearing certificates.

The First Party Sysem

Jefferson, who had returned to the United States in 1790 after serving as a diplomat in France, tried unsuccessfully to convince Washington to block the creation of a national bank. He also took issue with what he perceived as favoritism given to commercial classes in the principal American cities. He thought urban life widened the gap between the wealthy few and an underclass of landless poor workers who, because of their oppressed condition, could never be good republican property owners. To him, Hamilton’s program seemed to encourage economic inequalities and work against the ordinary American yeoman.

Opposition to Hamilton, who had significant power in the new federal government, including the ear of President Washington, began in earnest in the early 1790s. Jefferson turned to his friend Philip Freneau to help organize the effort through the publication of the National Gazette as a counter to the Federalist press, especially the Gazette of the United States. From 1791 until 1793, when it ceased publication, Freneau’s partisan paper attacked Hamilton’s program and Washington’s administration. “Rules for Changing a Republic into a Monarchy,” written by Freneau, is an example of the type of attack aimed at the national government, and especially at the elitism of the Federalist Party. Newspapers in the 1790s became enormously important in American culture as partisans like Freneau attempted to sway public opinion. These newspapers did not aim to be objective; instead, they served to broadcast the views of a particular party.

Opposition to the Federalists led to the formation of Democratic-Republican societies, composed of men who felt the domestic policies of the Washington administration were designed to enrich the few while ignoring everyone else. Democratic-Republicans championed limited government. Their fear of centralized power originated in the experience of the 1760s and 1770s when the distant, overbearing, and seemingly corrupt British Parliament attempted to impose its will on the colonies. The 1787 federal constitution, written in secret by fifty-five wealthy men of property and standing, ignited fears of a similar menacing plot. To opponents, the Federalists promoted aristocracy and a monarchical government—a betrayal of what many believed to be the goal of the American Revolution.

The Bank War

The Bank of the United States twenty-year charter expired in 1811. Congress, swayed by the majority’s hostility to the bank as an institution catering to the wealthy elite, did not renew the charter at that time. In its place, Congress approved a new national bank—the Second Bank of the United States—in 1816. It too had a twenty-year charter, set to expire in 1836.

The Second Bank of the United States was created to stabilize the banking system. More than two hundred banks existed in the United States in 1816, and almost all of them issued paper money. In other words, citizens faced a bewildering welter of paper money with no standard value. In fact, the problem of paper money had contributed significantly to the Panic of 1819.

In the 1820s, the national bank moved into a magnificent new building in Philadelphia. However, despite Congress’s approval of the Second Bank of the United States, a great many people continued to view it as tool of the wealthy, an anti-democratic force. President Jackson was among them; he had faced economic crises of his own during his days speculating in land, an experience that had made him uneasy about paper money. To Jackson, hard currency—that is, gold or silver—was the far better alternative. The president also personally disliked the bank’s director, Nicholas Biddle.

A large part of the allure of mass democracy for politicians was the opportunity to capture the anger and resentment of ordinary Americans against what they saw as the privileges of a few. One of the leading opponents of the bank was Thomas Hart Benton, a senator from Missouri, who declared that the bank served “to make the rich richer, and the poor poorer.” The self-important statements of Biddle, who claimed to have more power that President Jackson, helped fuel sentiments like Benton’s.

In the reelection campaign of 1832, Jackson’s opponents in Congress, including Henry Clay, hoped to use their support of the bank to their advantage. In January 1832, they pushed for legislation that would recharter it, even though its charter was not scheduled to expire until 1836. When the bill for re-chartering passed and came to President Jackson, he used his executive authority to veto the measure.

The defeat of the Second Bank of the United States demonstrates Jackson’s ability to focus on the specific issues that aroused the democratic majority. Jackson understood people’s anger and distrust toward the bank, which stood as an emblem of special privilege and big government. He skillfully used that perception to his advantage, presenting the bank issue as a struggle of ordinary people against a rapacious elite class who cared nothing for the public and pursued only their own selfish ends. As Jackson portrayed it, his was a battle for small government and ordinary Americans. His stand against what bank opponents called the “monster bank” proved very popular, and the Democratic press lionized him for it. In the election of 1832, Jackson received nearly 53 percent of the popular vote against his opponent Henry Clay.

Jackson’s veto was only one part of the war on the “monster bank.” In 1833, the president removed the deposits from the national bank and placed them in state banks. Biddle, the bank’s director, retaliated by restricting loans to the state banks, resulting in a reduction of the money supply. The financial turmoil only increased when Jackson issued an executive order known as the Specie Circular, which required that western land sales be conducted using gold or silver only. Unfortunately, this policy proved a disaster when the Bank of England, the source of much of the hard currency borrowed by American businesses, dramatically cut back on loans to the United States. Without the flow of hard currency from England, American depositors drained the gold and silver from their own domestic banks, making hard currency scarce. Adding to the economic distress of the late 1830s, cotton prices plummeted, contributing to a financial crisis called the Panic of 1837. This economic panic would prove politically useful for Jackson’s opponents in the coming years and Van Buren, elected president in 1836, would pay the price for Jackson’s hard-currency preferences.

Source: Corbett, P.S., Janssen V., Lund, J., Pfannestiel, T., Vickery, P., & Waskiewicz, S. U.S. History. OpenStax. 30 December 2014.

Summary

Alexander Hamilton served as the United States’ first Secretary of the Treasury. In this position, Hamilton effectively lobbied for the creation of the Bank of the United States. Thomas Jefferson deeply opposed the creation of the Bank of the United States. Andrew Jackson viewed the Bank of the United States as a corrupt institution that benefited the wealthy at the expense of the masses. Jackson ended the practice of depositing federal funds in the Bank of the United States. Jackson also vetoed a bill that would have extended the charter of the Bank of the United States. From 1830 to 1836, the number of state-chartered banks in the United States increased dramatically. Jackson’s actions against the Bank of the United States sparked a major financial crisis in the nation.